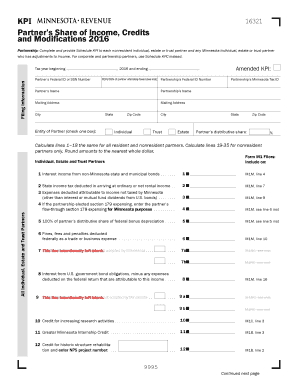

ME Finance Authority of Maine Balance Sheet 2001-2025 free printable template

Show details

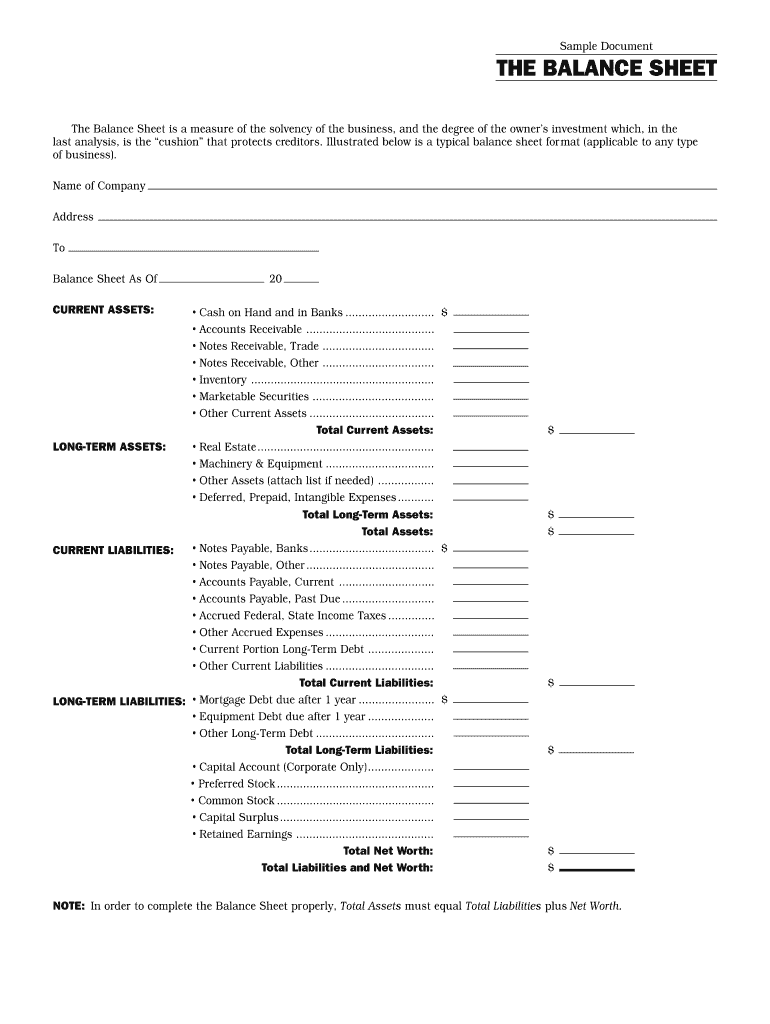

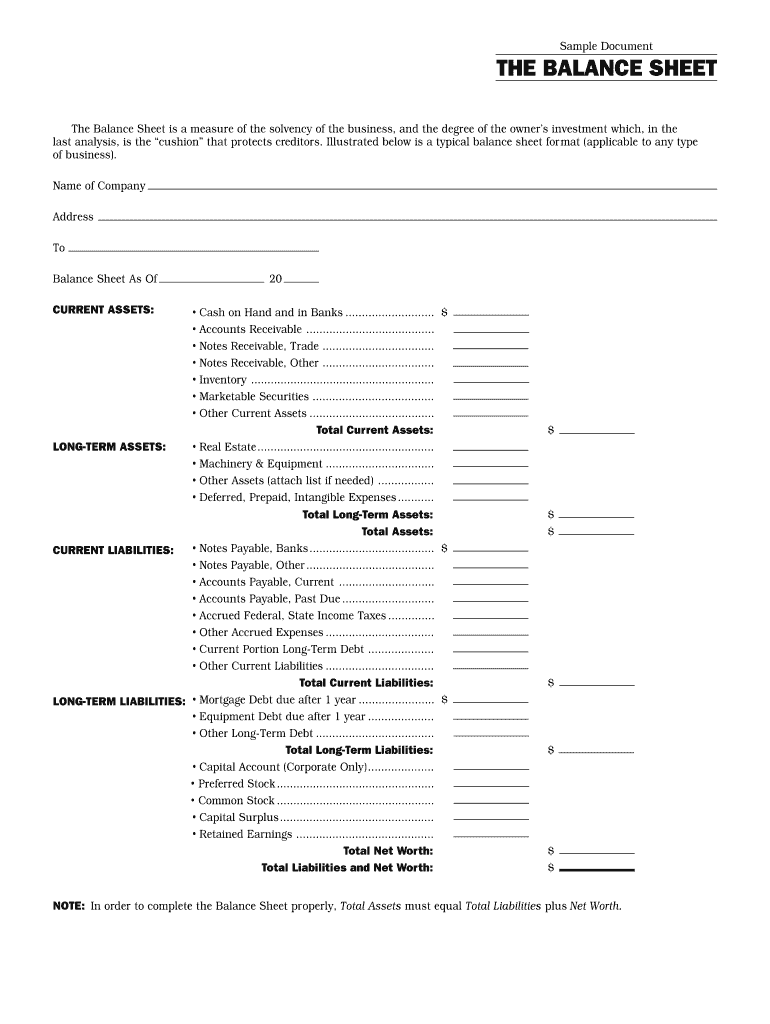

Sample Document THE BALANCE SHEET The Balance Sheet is a measure of the solvency of the business, and the degree of the owner s investment which, in the last analysis, is the cushion that protects

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign interim balance sheet example form

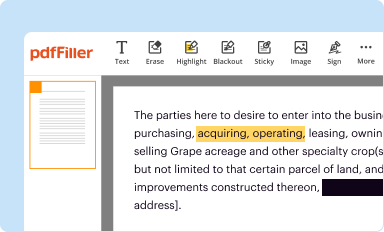

Edit your ytd balance sheet template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interim balance sheet template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ytd balance sheet online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit year to date balance sheet template form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out year to date balance sheet example form

How to fill out ME Finance Authority of Maine Balance Sheet

01

Begin with the heading of the balance sheet, stating 'Balance Sheet of [Your Organization]'.

02

Include the date of the financial statement to clarify the reporting period.

03

Divide the sheet into two sections: Assets and Liabilities & Equity.

04

Under Assets, list current assets like cash, accounts receivable, and inventory.

05

List non-current assets such as property, equipment, and long-term investments.

06

Total the assets at the bottom of the assets section.

07

Under Liabilities, list current liabilities including accounts payable and short-term loans.

08

List long-term liabilities such as mortgages and long-term loans.

09

Calculate the total liabilities at the bottom of the liabilities section.

10

Under Equity, include contributed capital and retained earnings.

11

Total the liabilities and equity sections.

12

Ensure that the total assets equal the total liabilities and equity, confirming the balance.

Who needs ME Finance Authority of Maine Balance Sheet?

01

Organizations applying for funding or financial support from the ME Finance Authority of Maine.

02

Businesses seeking to present their financial health to potential investors or partners.

03

Non-profit organizations that need to demonstrate financial accountability.

04

Entities undergoing audits or compliance checks that require a balance sheet.

Fill

interim ytd balance sheet

: Try Risk Free

People Also Ask about year to date balance

What is a YTD balance sheet?

Year-to-date refers to the cumulative balance appearing in an income statement account for the current year, through the end of the most recent reporting period. Thus, for financial statements using the calendar year, the concept refers to the period between January 1 and the current date.

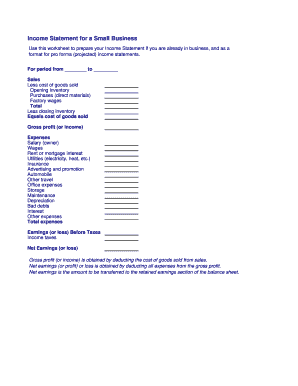

What should interim financial reports include?

Interim financial statements contain the same documents as will be found in annual financial statements - that is, the income statement, balance sheet, and statement of cash flows. The line items appearing in these documents will also match the ones found in annual financial statements.

How do you prepare interim financial statements?

How to Make Interim Financial Statements for a Small Business Enter all your expenses. Enter all your sales. Recognize interest paid on debt. Reconcile all accounts. Set the basis for your financial statements. Review your balance sheet. Review your profit and loss statement. Check your dates.

Are interim financial statements required?

IFRS Standards do not require companies to prepare interim financial statements, but many companies do so, either by choice or to comply with laws, regulations or contractual requirements.

What is an example of an interim statement?

A quarterly report is an example of an interim statement because it is issued before year end.

What is an interim balance sheet?

Interim financial statements are financial statements that cover a period of less than one year. They are used to convey information about the performance of the issuing entity prior to the end of the normal reporting year, and so are closely followed by investors.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is interim ytd balance sheet?

Interim YTD (year-to-date) balance sheet is a snapshot of a company’s financial position at a particular point in time during the current year. It shows the assets, liabilities, and equity of a business as of the interim date. It can help management assess the financial health of the business and identify areas that need attention.

Who is required to file interim ytd balance sheet?

Interim YTD balance sheets are typically required by the SEC for publicly traded companies. They are also often required by private companies when applying for loans or investment capital.

How to fill out interim ytd balance sheet?

1. Begin by adding up all your assets and liabilities from the start of the period to the end of the period. This includes any transactions that have occurred during the period that need to be included.

2. Enter the total of assets and liabilities on the balance sheet.

3. Calculate the net income or loss for the period by subtracting total expenses from total income.

4. Add the net income or loss to the beginning balance of retained earnings to get the ending retained earnings balance.

5. Enter the total retained earnings on the balance sheet.

6. Calculate the equity section of the balance sheet by subtracting total liabilities from total assets.

7. Enter the total equity on the balance sheet.

8. Double-check the balance sheet to make sure all the totals are correct and the balance sheet balances.

What information must be reported on interim ytd balance sheet?

Typically, an interim YTD balance sheet will report the company’s assets, liabilities, and equity as of the date of the report. It should also include a reconciliation of the beginning and ending balances of the company’s accounts, as well as any significant changes to those accounts during the period. The interim YTD balance sheet should also report any changes to the company’s capital structure, such as the issuance of new stocks and bonds. Finally, the report should include any significant non-cash items, such as the depreciation of long-term assets or the amortization of intangible assets.

What is the purpose of interim ytd balance sheet?

The purpose of an interim year-to-date (YTD) balance sheet is to provide a snapshot of a company's financial position at a specific point in time during the year. It is typically prepared for reporting periods that are shorter than a full fiscal year, such as quarterly or semi-annually.

The interim YTD balance sheet allows stakeholders, such as management, investors, creditors, and regulatory authorities, to assess the financial health and performance of the company during the specified reporting period. It includes key information such as assets, liabilities, and shareholders' equity, providing insights into the company's liquidity, solvency, and overall financial stability.

By comparing interim YTD balance sheets from different reporting periods, stakeholders can analyze trends, identify changes in financial position, and make informed decisions about the company's future. It also facilitates tracking progress towards achieving financial objectives, identifying areas of concern, and adjusting strategies or making necessary corrections if needed.

How do I edit interim balance sheet straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing balance sheet year to date.

How can I fill out ME Finance Authority of Maine Balance Sheet on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your ME Finance Authority of Maine Balance Sheet. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out ME Finance Authority of Maine Balance Sheet on an Android device?

On an Android device, use the pdfFiller mobile app to finish your ME Finance Authority of Maine Balance Sheet. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is ME Finance Authority of Maine Balance Sheet?

The ME Finance Authority of Maine Balance Sheet is a financial statement that summarizes the assets, liabilities, and equity of the Maine Finance Authority at a specific point in time, providing a snapshot of its financial condition.

Who is required to file ME Finance Authority of Maine Balance Sheet?

Entities that have financial dealings or borrowing arrangements with the Maine Finance Authority, as well as those required to submit periodic financial statements for regulatory compliance, are required to file the ME Finance Authority of Maine Balance Sheet.

How to fill out ME Finance Authority of Maine Balance Sheet?

To fill out the ME Finance Authority of Maine Balance Sheet, you need to list all assets in one section, liabilities in another section, and calculate equity as the difference between total assets and total liabilities, ensuring to provide accurate figures and comply with applicable accounting standards.

What is the purpose of ME Finance Authority of Maine Balance Sheet?

The purpose of the ME Finance Authority of Maine Balance Sheet is to provide stakeholders, including lenders and regulatory bodies, with a clear view of the financial standing and fiscal health of the Authority, facilitating informed decision-making.

What information must be reported on ME Finance Authority of Maine Balance Sheet?

The ME Finance Authority of Maine Balance Sheet must report information relating to total assets (current and non-current), total liabilities (current and long-term), and total equity, including any restricted funds or reserves.

Fill out your ME Finance Authority of Maine Balance Sheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ME Finance Authority Of Maine Balance Sheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.